Planning for retirement with your partner?

It feels like gearing up to climb Everest together, doesn’t it?

But here’s the thing, it doesn’t have to be a solo journey, and it’s definitely more doable when you tackle it as a team.

Think about it, when was the last time you both sat down, maybe with a cup of coffee, and chatted about what you dream your retirement to look like?

It’s more of planning an extended vacation, but way longer and with more at stake.

Now, I’ve got to tell you, my partner and I had this moment.

We were sitting on our porch one evening, and we started dreaming out loud.

We talked about everything – from the places we’d love to visit to the kind of lifestyle we wanted to maintain after retirement.

It was eye-opening to see how aligned our visions were and it got us excited about the future.

There might be some bumps along the way, and you might need to adjust your route here and there.

But imagine reaching that peak together.

Here are some of the things I took out of that conversation:

10 Ways to Plan Your Retirement as a Couple

1. Start the Conversation Early

With retirement, it is never too early to start the conversation.

The earlier you start, the more time you have to save and plan for your future together.

Start talking about retirement early.

Discuss your dreams, goals, and expectations.

Do you want to travel the world or just relax on the porch with your grandkids?

Before you start planning, get on the same page.

It’s crucial to have these discussions early on because they set the foundation for all your future planning.

If you wait until you’re closer to retirement age, you might find that you have very different visions of what those years should look like.

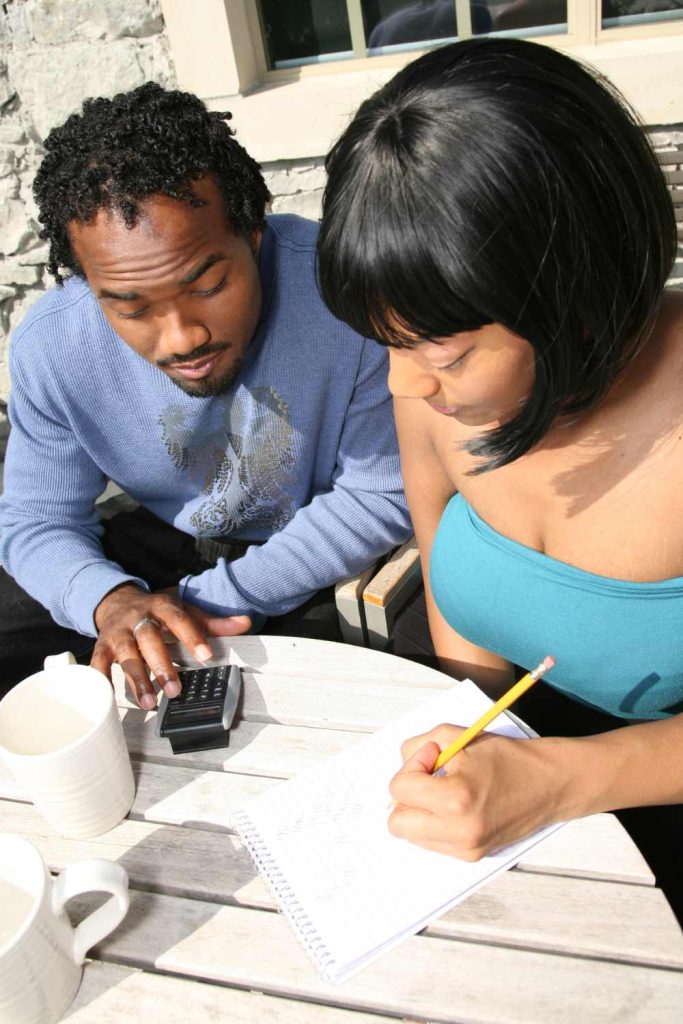

So, grab a cup of coffee or wine, sit down with your partner, and start dreaming together.

2. Assess Your Current Financial Situation

Before you can plan for the future, you need to know where you stand right now.

That means opening up those bank statements and retirement accounts and taking a good, hard look.

It might be scary, but it’s necessary.

Compare your assets and liabilities, and figure out how much you’ve saved so far.

If you haven’t started saving, it can give you a hint as to how to save and the amount to save.

This step is a bit like looking at your credit card statement after the holidays.

It’s not fun, but it’s essential if you want to get things in order.

Understanding your current financial situation can help you make informed decisions about how to reach your retirement goals.

3. Set Joint Retirement Goals

Once you know where you stand financially, it’s time to set some goals.

And no, “retiring rich” is not a specific goal. Be detailed.

Do you want to retire at 60 or 65? How much income will you need each year?

Make sure you and your partner are aligned in your goals.

Setting joint goals is like planning a road trip.

You need to know where you’re going and how you’re going to get there.

Having clear, shared goals, you can work together to achieve them and avoid any surprises down the road.

4. Create a Budget and Stick to It

Decide how much you need to save each month to reach your goals.

Then, stick to that budget like your life depends on it.

And remember, it’s okay to cut back on the daily lattes if it means a secure retirement.

A budget is your financial roadmap. Without it, you’re just driving aimlessly.

When you create and stick to a budget, you can ensure that you’re saving enough to meet your retirement goals and that you won’t be caught off guard by unexpected expenses.

5. Invest Wisely Together

Investing is like choosing a restaurant, you both need to agree on where to go.

Look at different investment options and decide on a strategy that works for both of you.

Whether it’s stocks, bonds, or mutual funds, make sure your investments align with your retirement goals.

Investing can be intimidating, but it doesn’t have to be.

6. Consider Health Care Costs

Healthcare costs in retirement can be a major buzzkill.

But it’s better to plan for them now than to be surprised later.

Look into long-term care insurance and other health care options.

Make sure you both understand the costs involved and plan accordingly.

Healthcare costs are one of the biggest expenses in retirement, and they can quickly derail even the best-laid plans.

7. Review and Adjust Your Plan Regularly

Your retirement plan is not a “set it and forget it” kind of deal. Life happens, and plans change.

Make sure you review your retirement plan regularly and make adjustments as needed.

If you get a raise, save more. If you have a financial setback, adjust your plan.

Think of your retirement plan as a living document.

It’s not something you create once and then never look at again.

Reviewing and adjusting your plan regularly can ensure that it continues to meet your needs and goals.

8. Maximize Your Social Security Benefits

Do you know how social security can feel like a big ol’ puzzle?

If you don’t fit the pieces together just right, you’re left staring at an incomplete picture and scratching your head.

Let me tell you, understanding how to max out those Social Security benefits is key.

It could mean waiting a bit before you start collecting or figuring things out with your partner to get the most bang for your buck.

Honestly, getting the most out of Social Security can feel like you’re playing a strategic game.

But trust me, it’s a game worth getting into.

It’s like ensuring you’re squeezing every bit of juice out of this crucial retirement benefit.

So, let’s not leave our future selves hanging, alright?

Diving into the nitty-gritty of Social Security might not be the most thrilling adventure, but it could make a big difference in the long run.

Let’s get savvy about our benefits and make sure we’re setting ourselves up for a cozy retirement.

After all, a little effort now can lead to a lot of peace of mind later.

9. Plan for the Unexpected

Life is full of surprises, and not all of them are pleasant.

Make sure you have a plan in place for the unexpected.

This might include having an emergency fund or getting the right insurance coverage.

Planning for the unexpected is like having a safety net.

It won’t prevent bad things from happening, but it can help you recover more quickly when they do.

10. Enjoy the Journey

Planning for retirement can be stressful, but don’t forget to enjoy the journey.

Take time to celebrate your progress and enjoy life along the way.

After all, retirement is not just about the destination, but the journey as well.

It’s easy to get so focused on the future that you forget to enjoy the present.

But life is happening right now, and it’s important to make the most of it.

Planning for retirement as a couple can be challenging, but it’s also an opportunity to strengthen your relationship and work towards a common goal.

Planning for retirement together not only secures your financial future but also builds a stronger bond between you and your partner.

It’s about shared dreams, mutual sacrifices, and collective victories.

As you navigate this journey, keep the lines of communication open, be flexible with your plans, and most importantly, enjoy the ride together.

Remember, the key to successful retirement planning is communication and teamwork.

So, start the conversation today and work together to build the retirement of your dreams.

And don’t forget to laugh along the way, after all, retirement should be fun!